People are pursuing compensation claims for the Los Angeles wildfires that ravaged their lives. The wildfires that swept through Los Angeles County and the surrounding areas in January 2025 devastated over 24,000 acres of land, leveled over 15,000 buildings, and claimed dozens of lives. Compensation claims may be filed against the individuals, companies, government entities, and Southern California Edison, who may be at fault for the fires.

Victims may qualify for compensation by submitting an insurance claim, joining a class action lawsuit, or suing an insurance company, Southern California Edison, or another wrongdoer. If the Los Angeles wildfires impacted you, contact our law firm today. We may be able to connect you to a settlement or other compensation, even if you suffered minor damages.

If you were impacted by the wildfire in any way at all, contact King Law today at 585.496.2648 for a free case review. You can also submit a contact form online, and a member of our intake team will reach out to you as soon as possible.

About LA Wildfire Compensation Claims:

Types of Wildfire Damages People Can Be Compensated For

How Will Fire Victims Receive Compensation for Claims?

Grounds for Compensation Claims in Los Angeles Wildfires

Navigating Claims Against Utility Companies

Pursuing Insurance Claims After the Los Angeles Wildfires

Why Fire Victims Need a Lawyer to Pursue Compensation and Claims

Get a Free Case Review to Learn More About Claims and Compensation

Types of Wildfire Damages People Can Be Compensated For

The LA County fires consumed tens of thousands of acres of residential, commercial, and recreational land and habitat. The Eaton and Palisades fires destroyed or damaged over 17,300 structures and caused many thousands to flee to safety. People who suffered any loss in this inferno may be entitled to money through their insurance policy or in a lawsuit against a government agency, Southern California Edison, their insurer, or another person or entity.

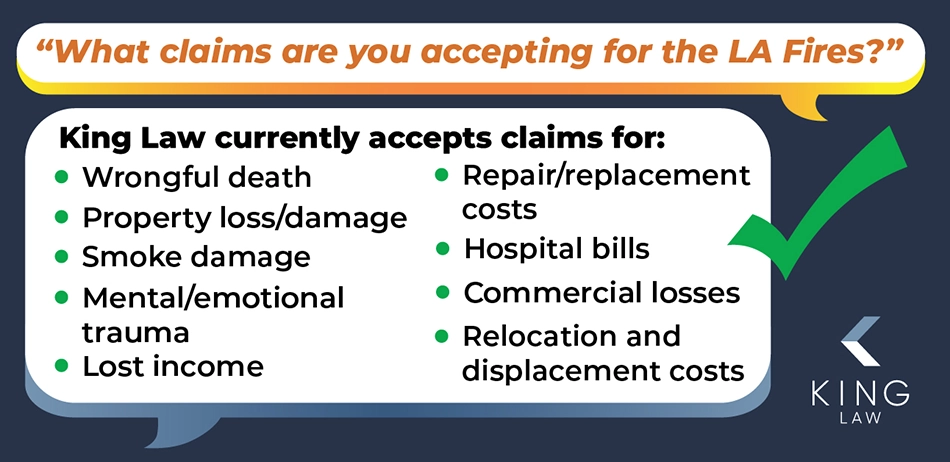

Compensation Claims King Law Is Accepting

Our law firm is partnering with victims as they, their families, and communities grapple with this tragedy. We are fighting to connect victims with the funds they need to rebuild. King Law is handling compensation claims related to the following losses:

- Wrongful death

- Property damage such as a leveled home, incinerated vehicle, or destroyed landscape

- Smoke damage

- The mental and emotional trauma of living through a fire

- Displacement and evacuation expenses

- Lost income

- Expenses to repair or replace property

- Hospital bills associated with the fire (e.g., urgent care visit, hospitalization, surgery)

- Commercial losses

If you experienced loss or displacement because of the Eaton, Palisades, Hurst, or other LA County wildfires, our firm can help. We welcome your call and the opportunity to help you access funds to help you through this pain and uncertainty.

How Will Fire Victims Receive Compensation for Claims?

Victims of the LA fires may receive restitution in several different ways. For example, a victim may file a claim with their insurance provider to reimburse their fire-related losses—like their home, car, or valuables. If their insurance agency denies the claim in bad faith or refuses to pay out the full value of the claim, the victim may sue their insurer to seek a comprehensive settlement package.

Another option is for a victim to file a lawsuit against the person or agency responsible for the losses they experienced. For instance, victims of the Eaton and Hurst fires may have a legal claim against Southern California Edison, along with their local government or another person, like their landlord. Early reports show that Southern California Edison’s equipment may have caused the Eaton and Hurst Fires.

As details emerge and people take legal action, class action lawsuits may form, providing plaintiffs—people who were wronged—a way to band together against a common wrongdoer. For example, if the utility company is at fault, victims may form a class action to sue the utility for improperly maintaining its power equipment and limiting the risk of fires.

Grounds for Compensation Claims in Los Angeles Wildfires

Victims of the Los Angeles wildfires may request compensation by leveraging several legal theories. For example, the victim may file a lawsuit based on negligence if they can prove someone—a person or business—did something wrong that caused or contributed to the fire’s impact. Other bad actors may be strictly liable for the damage inflicted on the victim by virtue of who they are—e.g., a utility company—or what they were doing at the time. Victims who want to learn more about the potential legal avenues are encouraged to consult a seasoned wildfire lawyer.

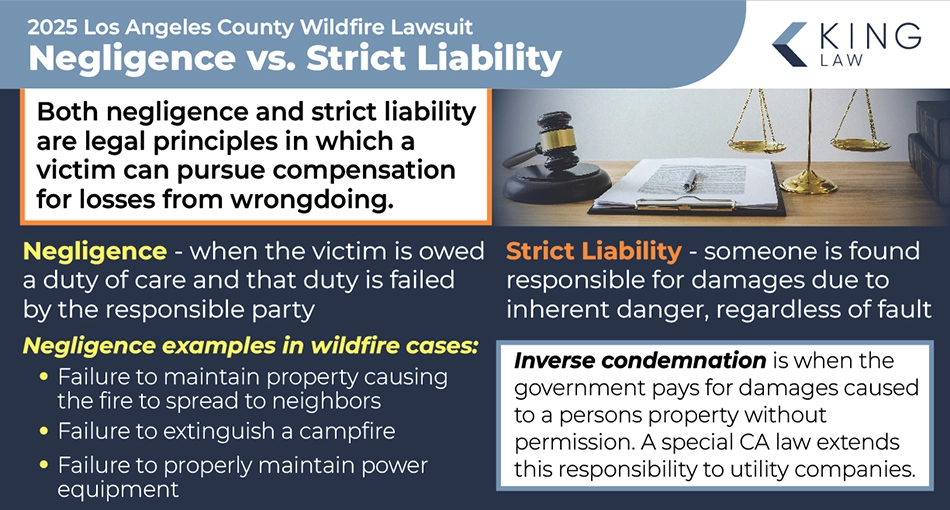

Negligence vs. Strict Liability in Wildfire Cases

Negligence and strict liability are common legal principles wildfire victims might use to sue a wrongdoer or seek money from their insurance provider. Negligence is when someone owes the victim the responsibility of acting (or refraining from acting) in a particular way that causes harm. In a wildfire case, negligence might look like someone not correctly maintaining their yard, equipment, or car, causing the fire to spread to neighbors. According to the National Park Service, about 85 percent of all wildfires are caused by human error, such as failure to properly extinguish campfires or not fixing faulty power equipment.

Strict liability means that someone—like the utility company—is legally liable even if the victim does not prove they did something wrong. For example, a utility company in California may be responsible for compensating fire victims even if it did not cause the fire. Insurance companies may process fire-related claims differently depending on the policy’s language, the unique circumstances, and who is or may be legally liable for the damage.

Inverse Condemnation and Public Utility Actions

California’s special inverse condemnation law extends to utility companies like Southern California Edison and Pacific Gas & Electric. Inverse condemnation is when the government pays someone money because it damages their property without asking first. For example, the government may tear up someone’s yard while building a new road or updating the city pipes.

In California, people may also recover compensation for damages caused by wildfires. To potentially qualify, the person needs to prove that the utility company’s equipment started or contributed to the blaze. However, the person may not have to prove that the utility company’s negligence or mistakes caused the fire. Because of this, many Los Angeles fire victims may call on an inverse condemnation policy to help them secure compensation.

Navigating Claims Against Utility Companies

Claims against utility companies—like Southern California Edison—can be nuanced and complex. For starters, proving a direct link between the first spark, an expansive wildfire, and the injuries and losses can be challenging. Victims can put together a solid legal case by arming themselves working with a wildfire attorney to prepare robust evidence, including:

- Utility maintenance records, which the utility company may have filed with governmental entities like the California Public Utility Commission

- Eyewitness testimony, such as neighbors, family, colleagues

- Forensic and expert testimony

- Photographs or video footage before and after the fire

- Medical documentation

- Receipts for evacuation or displacement costs

- Property repair or replacement bills related to the fire or its fallout

Victims can use this evidence to tell the story of what happened to them and explain how the law entitles them to compensation. Documents such as receipts, repair bills, and replacement estimates can also support victims’ claims for monetary damages.

Utility companies may try to counter the victim’s arguments, saying their policy does not cover these damages, deadlines were missed, or the victim did not follow opaque administrative processes. Victims can help arm themselves against these tactics by partnering with an attorney who can craft and champion a strong legal strategy.

The Role of Class Action Lawsuits Against Utility Companies

Class action lawsuits can be an effective way for people to seek justice after suffering damage from a wildfire. In a class action lawsuit, a large group of plaintiffs combines forces against one or more defendants for the same wrongful act. For example, dozens of wildfire casualties may sue Southern California Edison alleging its electrical equipment emitted the first spark that started the fire. They might also sue Southern California Edison for not turning off its equipment despite multiple warnings about heightened fire risks.

Class actions can be compelling, allowing plaintiffs to reduce their legal fees and increase their leverage during negotiation discussions. Rather than facing a large corporation alone, a plaintiff can raise their voice by partnering with dozens or hundreds of others. However, banding together can prevent individual plaintiffs from sharing their unique stories and grievances. Additionally, each plaintiff’s payout is standardized, so it may be lower than their actual losses.

Statute of Limitations and Evidence Preservation

State and federal laws impose deadlines—called the statute of limitations—on how long people have to file a legal claim against a business or individual who harmed them. The time limit someone has to follow depends on who they are suing, for what reason, and what they seek compensation for.

For example, California law requires some victims to file a lawsuit within two years if they request restitution for personal injuries. For claims involving property damage or loss, victims in California may give victims up to three years to take legal action. People who are under 18, incapacitated, under a legal disability, or suing the government, however, may have to follow a different timetable.

While preparing to file a lawsuit, victims or their attorneys can take steps to preserve and gather evidence. For example, they can send preliminary letters to the utility company to preserve evidence related to the fire. They can also take photographs, collect receipts, and write down their thoughts to begin to reconstruct what occurred.

Pursuing Insurance Claims After the Los Angeles Wildfires

Wildfires can be devastating, causing losses of life, habitat, property, and businesses. When the flames reach containment status, California wildfire victims must take on their insurance providers, whose plans may be archaic, complex, and flawed. People who have California’s Fair Access to Insurance Requirements (FAIR) insurance plans may have a particularly challenging path ahead. Collaborating with a reputable attorney handling fire insurance legal claims can help people navigate their insurance plans confidently and successfully.

Decoding Your Insurance Policy for Wildfire Coverage

Insurance policies help people cover the costs if an event—like a wildfire—harms them or their property. Some items are part of the policy automatically, but others might be an optional add-on for which the insured would pay extra. For example, many homeowner’s policies cover wildfire damage; however, car insurance coverage may not automatically cover fire-related losses to the vehicle.

Depending on the coverage selection, the insurance company may pay for housing or transportation while the claim is settled. Additionally, the insurer may offer to pay to repair or replace the damaged or destroyed property. The insurance contract may limit the dollar amount a claimant can receive and exclude some types of damages altogether.

Handling Insurance Claim Denials or Delays

Insurance claims due to wildfire damage can be nuanced and frustrating for many victims. An experienced attorney can help victims navigate the complexities of their policies and filing claims. Insurance providers may require victims to submit multiple rounds of forms, evidence, and recorded statements. Moreover, if the insurer faces a high volume of claims simultaneously, this can delay processing times.

Insurance companies may deny or refuse fair compensation for wildfire claims for many reasons. They may try to argue the person does not have fire coverage or did not meet their deductible. They may also come up with an estimate far below the actual market value of the lost property.

If their claim is denied or they believe they are not being given a fair deal, the insured person has options. They may be able to file an appeal or challenge the denial using the insurance company’s administrative procedures. The victim may also file a formal lawsuit against the insurance company or whoever caused the wildfire. Victims may benefit from partnering with a knowledgeable lawyer to help them negotiate a fair settlement package for wildfire damages.

Bad Faith Insurance Practices in Wildfire Claims

Insurance companies may delay or deny claims in bad faith for many reasons. For example, insurance adjusters may needlessly say they need more time to complete their investigation or are missing paperwork. Sometimes, these delays are necessary. Other times, it is a tactic used to wear victims down so they accept an unfair offer or drop the claim entirely.

Additionally, insurers may misconstrue the coverage language in the contract, trying to argue that the fire damage is an uninsured loss. In some cases, the insurance company may draw on technicalities—such as different deadlines in the contract—to try to sidestep liability.

Another technique insurance companies may use to avoid paying the full value of a claim is to provide unfairly low settlement offers for property loss or personal injuries. If Los Angeles County fire victims suspect bad faith when dealing with their insurance provider, an attorney can be an empowering resource.

Why Fire Victims Need a Lawyer to Pursue Compensation and Claims

Lawyers can provide immense and timely support to victims of the Los Angeles County wildfires that ravaged Malibu, Topanga, Sylmar, San Fernando, Pasadena, Altadena, and the surrounding regions in January 2025. They can help victims identify and pursue all avenues of recovery, such as suing a utility company, local governments, businesses, or individuals.

Lawyers can also help them file a bad faith claim against their insurer, potentially allowing the victims to increase their compensation offer or settlement. Attorneys can also assist with the appeals process for insurance claims and lawsuits, working to diligently turn over every stone to maximize the victims’ recovery chances. Some attorneys even provide free case reviews, allowing victims to learn more about their options without paying upfront legal costs.

Get a Free Case Review to Learn More About Claims and Compensation

Surviving a wildfire can leave a lasting impression on you, your family, and your community. In the days, weeks, and months after the event, you may face chaotic and unfamiliar situations. On top of this, you are tasked with filing insurance claims, fielding repair estimates, and any other fire-related events. Our attorneys can help relieve this stress by offering free consultations so you can understand your options.

File an LA Fire Compensation Claim Today

Reach out to King Law at (585) 496-2648 to discuss your wildfire case immediately and see how our team of legal partners can help. We can diligently review your legal claim to determine how you might secure fair compensation. We can also champion the case on your behalf, handling negotiations, legal filings, and court dates. Our legal partners are taking Los Angeles wildfire cases on contingency, meaning you do not pay any upfront legal fees for us to evaluate or handle your claim if you work with us.

How King Law Can Help You Pursue Claims and Compensation

King Law and its partners are helping wildfire victims file lawsuits against:

- Insurance companies

- Local government agencies

- Businesses

- Southern California Edison and other utilities

- Individuals who may have caused or contributed to the fire or its consequences

Our legal partners can help you discover if you are eligible to bring a lawsuit or claim against these entities and others. We share your frustration and heartache and want to help you and your family take a strong stand against those responsible for this tragedy.